In this article, we’re going to do an analysis of AAPL to determine if it’s a good candidate for selling put options. The strategy that will be used is known as naked put writing.

Long-term, the goal of this strategy is to capture the majority of premium by buying back the options at less than $0.40.

Start With The General Market Environment

Before selling a put option, understanding the general market environment is critical. It will set an overall context and bias.

The current environment has been lofty. The S&P 500 is at all-time highs and the VIX is down to 9.75. Put option sellers already know premiums will be depressed. Meaning, returns will also be depressed.

Analyzing AAPL’s Stock

AAPL has also reached new highs recently. It continues up and to the right. AAPL is a low volatile stock. It’s also a blue chip.

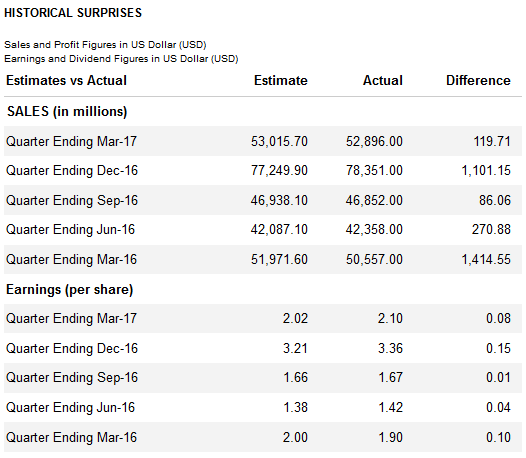

AAPL has been steadily beating its earnings. It’s last earnings date was on 5/2/17. The company reported EPS of $2.10 for the quarter and revenue of $52.896 billion.

Below is what earnings have looked like compared to street estimates:

Source: Reuters

What happened to the stock on the last four earnings:

7/26/16 – Small dip just before earnings then gap up.

10/25/16 – Gap down and continued from $117 area to low of $104.08 on 11/14/16 before resuming uptrend.

1/31/17 – Another gap up, resuming uptrend.

5/2/17 – Little movement in the stock then big up on 5/5, resuming uptrend.

Given the above history and an overall trend that continues up and to the right, this trend doesn’t seem to be in jeopardy for the foreseeable future.

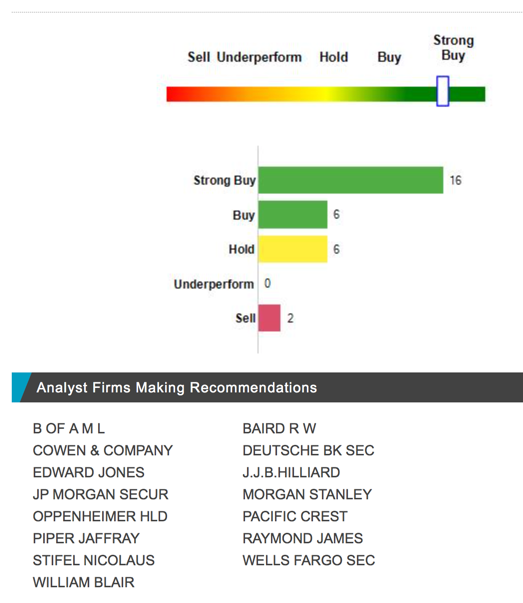

We can also see that analyst overall (16/30) believe the stock is a strong buy:

Source: Nasdaq

Without looking at AAPL’s options, there’s a few things that are likely true:

- Low volatility stocks often equal low premiums, which means low returns.

- Blue chips are often low volatility stocks.

- AAPL’s stock is $155.45 at the close of Friday. This means it will require high margin, locking up capital and additional opportunities.

All of that said, AAPL is also fairly low risk. AAPL isn’t filing for bankruptcy anytime soon. It’s unlikely we’ll see some huge drop in the stock. As a put option seller, we definitely don’t want to see the stock going below our strike.

Finding The Right Option Strike

Looking at AAPL’s stock chart, there are a few good candidates for option strikes. Meaning, places we don’t want to see the stock fall below.

One price is at 140. There appears to be some support in this area. Noticing the gap between 122 and 126, this area should also be good. Perhaps even just at 130. This allows for $25 of margin or padding in case of an unexpected stock drop.

Analyzing AAPL’s Options

Given that AAPL is a low volatility stock, we’ll have to go out further than the current month. Probably out as much as 2 – 4 months to have any sort of viable return.

The Jul 140 is .32/.33 for bid/ask prices. Margin on AAPL is 20% for naked put writing, which is about as low as it gets. Plugging these numbers into a put option return formula gives us a 2.01% return.

Using numbers from the 130 strikes (.09/.10) bumps it up to 2.93% return. But who wants to captures .09 premium? Commissions alone will eat that up.

I don’t know about you but a 2% return on capital just isn’t that appealing. This is almost CD territory. Does this mean AAPL is out? Not exactly. There are still a few further out strikes to consider.

Let’s take a look at the next monthly strike, which is August. Going with a 140 strike again and 1.11/1.13 bid/ask, we get a return of 6.63%. This is very good. I consider anything over 5% as worthy.

Today’s date is 6/5. If we hold until expiration, which is 8/18, that’s about a 2.5 month holding period. Annualizing the return gives us 31.82% return.

Mentioned earlier in the article though, we aren’t likely to capture the full 31.82% return since we’ll be buying back a little early.

If the return is all we’d need to consider, AAPL would be a great candidate for put option selling.

Determining Risk Factors

However, we certainly need to consider more than just returns. What risks might be involved with this trade?

It looks like earnings for AAPL are coming up on July 25. I don’t like holding through earnings since anything can happen. We might decide to buy back AAPL before earnings. This will lower our return since we won’t be capturing the full premium.

With a 140 strike, we’re only $15 away from the current stock price. It’s a nice margin of error but still likely within the swing amount of this stock. Going down to 130 is even better but returns will go down as well.

What else might push this stock lower and below our strike? With a VIX at 9.75, the market is virtually screaming temporary top. But if the market backs off and AAPL with it, will it rise again before our expiration? Or could we be stuck with a stock at $135, just below our strike.

These are certainly factors to consider and every trader will handle it different.

To Trade AAPL Or Not

I can’t say whether you should take this trade or not. Trading is an extremely personal endeavor. We all have different risk tolerances, return expectations and of course levels of greed. But these are only a small number of the very many variables that separate all traders and makes each of our styles unique.